What gemstone is an engagement associated with? Of course with a diamond. Why? As I wrote in another article, this is the result of a brilliant advertising campaign that has for decades instilled in us the idea that diamonds are rare, eternal and priceless. But how to choose the best stone for investment?

Sometimes, what the market tries to impose on us is not the best way to allocate capital. For the seller, the sales results count. On the other hand, the good of the client is usually relegated to the background.

This article is not about an engagement or selling. These two terms are just examples intended to give you a complete picture. The basis for the purchase should be the knowledge of the rules according to which the stones are valued, in order to then make an informed choice. Below I have compiled a few of the most important rules for selecting stones for investment purposes.

Rule 1. Difficult accessibility

How is it possible that when a customer wants to buy a white diamond, I have no problem finding exactly what they are looking for? One call to the broker and every size, clarity and cut is at your fingertips. Such diamonds are not difficult to find. And if there is an abundance of something, the gain in value is negligible.

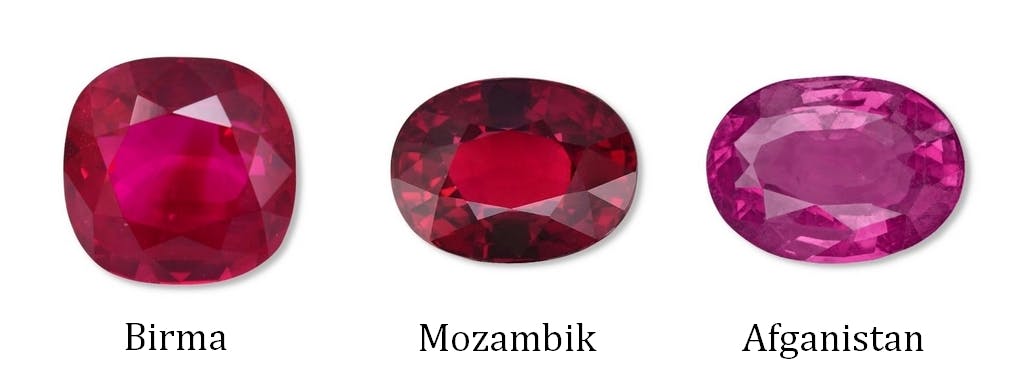

Then what gem is difficult to obtain? If anyone asked me, I would say "Burmese ruby" right away. As the name suggests, this stone is mined in only one place on the planet. It has a unique, blood-red saturation that cannot be found anywhere else. High clarity stones of this type significantly exceed the price of white diamonds. The search for them may take months.

The same applies to Ceylon sapphires. Once upon a time, I had a situation where the customer hesitated and the stone was sold. It took 2 months to find a similar one, and its price was already much higher.

Since we are talking about costs, what is the most expensive stone? It is neither a diamond nor even a Ruby. The most expensive gem is Jadeite. Some time ago, at an auction in Burma, I saw a fragment of spoil from a mine with a tiny line of green jade in it. It cost EUR 8,000,000. Of course, a stone does not have to cost as much to be a good investment. By comparison, a top-notch emerald can cost $ 100,000 / ct. A beautiful mineral with better parameters than the emerald tsavorite was discovered relatively recently. As the deposit is still in operation, the price is relatively low, unlike the emerald, the natural deposits of which are running out. However, it will be similar with Tsavorite in a few years. It is mined in only one place on Earth. Its deposit will run out at some time and then the price will skyrocket.

Colour diamonds are another unique way to invest. In highly saturated colours of yellow, pink, blue and green, these stones have a high profit ratio and relatively easy liquidity of capital. Why? Because they are very rare and in great demand by the market.

Rule 2. High parameters

Coloured diamonds and other stones, with their unique, most desirable colour, high purity and exquisite cut, are very valuable. Their value will grow with the depletion of deposits. Statistics show that in the case of diamonds, for every four mines that close, there is one that opens. That is why the De Beers conglomerate officially entered the synthetic diamond market. For some diamond specialists and lovers, this was a shocking message. But there is only one conclusion: the prices of high-class stones will continue to rise.

The value is also influenced by the certificate attached to the jewel from a reputable institute. It accurately describes all the parameters of the stone. Such a laboratory will also ensure that the certificate number is engraved on the edge of the gem, which makes it difficult to tamper with or steal.

Rule 3. Origin

The value of the stones is also influenced by their origin. Rubies from the Mogok mine in Burma, Emeralds from Muzo in Colombia, Sapphires from Ceylon in Sri Lanka, Opals from Lightning Ridge in Australia and Tsavoryt from the Lemshuko mine in Tanzania are stones with a reputation that will ring in the ears of any connoisseur.

Why is the origin of the stone so important? There are several reasons. One of them is the fact that armed conflicts persist in many places where the best stones are obtained. Another reason is the extremely difficult mining conditions. There can be a channel a kilometer deep into clay soil, dug with hands at a temperature of 45 degrees and 100% humidity. In other circumstances, the raw material is obtained by drilling in solid rock in frost at minus 40 degrees. Most mines are hundreds of kilometers away from any civilization. Many such sites have been closed due to the enormous mining costs. All these factors increase the value of the end product.

Rule 4. Security of Transactions

Where can you get stones that will be safe to invest in? The key is to rely on the expertise of a specialist. Over the years, our company has developed contacts with the best brokers in the world, able to find stones despite the most stringent requirements. We make the transaction through a secured Escrow payment system (the money is released from the deposit after receiving confirmation that we have received what was ordered). Thanks to this solution, the supplier bears all the risk.

Rule 5. Binding

Some keep investment stones in a safe. However, the best solution is to frame these unique products. Why? The value of such stones does not decrease. A gem becomes more attractive by adding complementary stones and framing them in a designer form of gold or platinum, as such the value increases. Such an investment also has a practical aspect. Jewellery can be put on and enjoyed every day, while most investment solutions are limited to passiveluy waiting for profit.

Knowing these 5 rules allow you to make the right investment choice. It is worth using professional advice to specify the goal. Once it is determined, it is worth using a secure transaction that will make the investment goal achievable without taking an unnecessary risk.